Personal Income Tax 2025 - Enter your income and location to estimate your tax burden. 2025 State Tax Rates and Brackets Tax Foundation, Taxation of foreign income for residents. The tax tables below include the tax rates, thresholds and allowances included in the thailand tax calculator 2025.

Enter your income and location to estimate your tax burden.

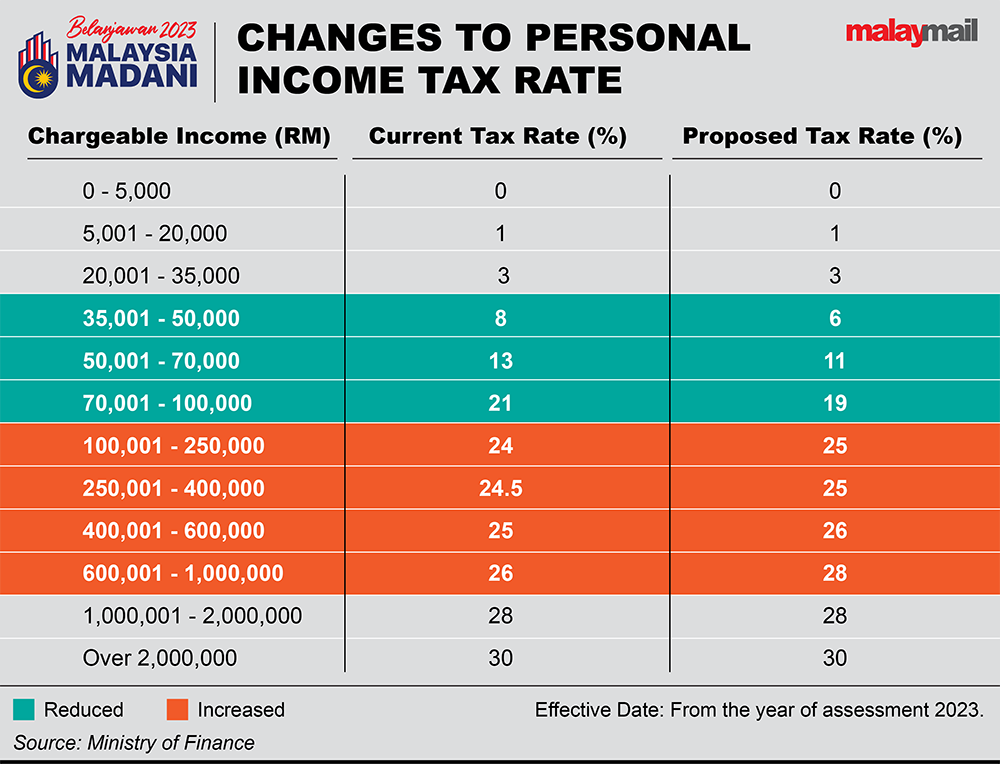

Why no tax rate rise for those earning above RM1m? Treasury sec, As announced in budget 2025, a personal tax rebate will be granted to all tax residents for year of assessment 2025. How much of your income falls within each tax band;.

Tax Relief 2025 Malaysia Printable Forms Free Online, Check out the latest income tax slabs and rates as per the new tax regime and old tax regime. How much of your income is above your personal allowance;

Singapore Personal Tax Guide + Tax Rebate and Reliefs (2022, Tax residence status of individuals. How much income tax you pay in each tax year depends on:

An individual is regarded as tax resident if he meets any of the following conditions, i.e. For thai residents, foreign income is taxable if it is brought into thailand within the same year it is earned.

Window to Enjoy Tax Reliefs Closing CN Advisory, On 21 december 2025 thailand tax ministerial regulation no.391 was gazetted, granting a personal income tax shopping allowance for the 2025 year. As announced in budget 2025, a personal tax rebate will be granted to all tax residents for year of assessment 2025.

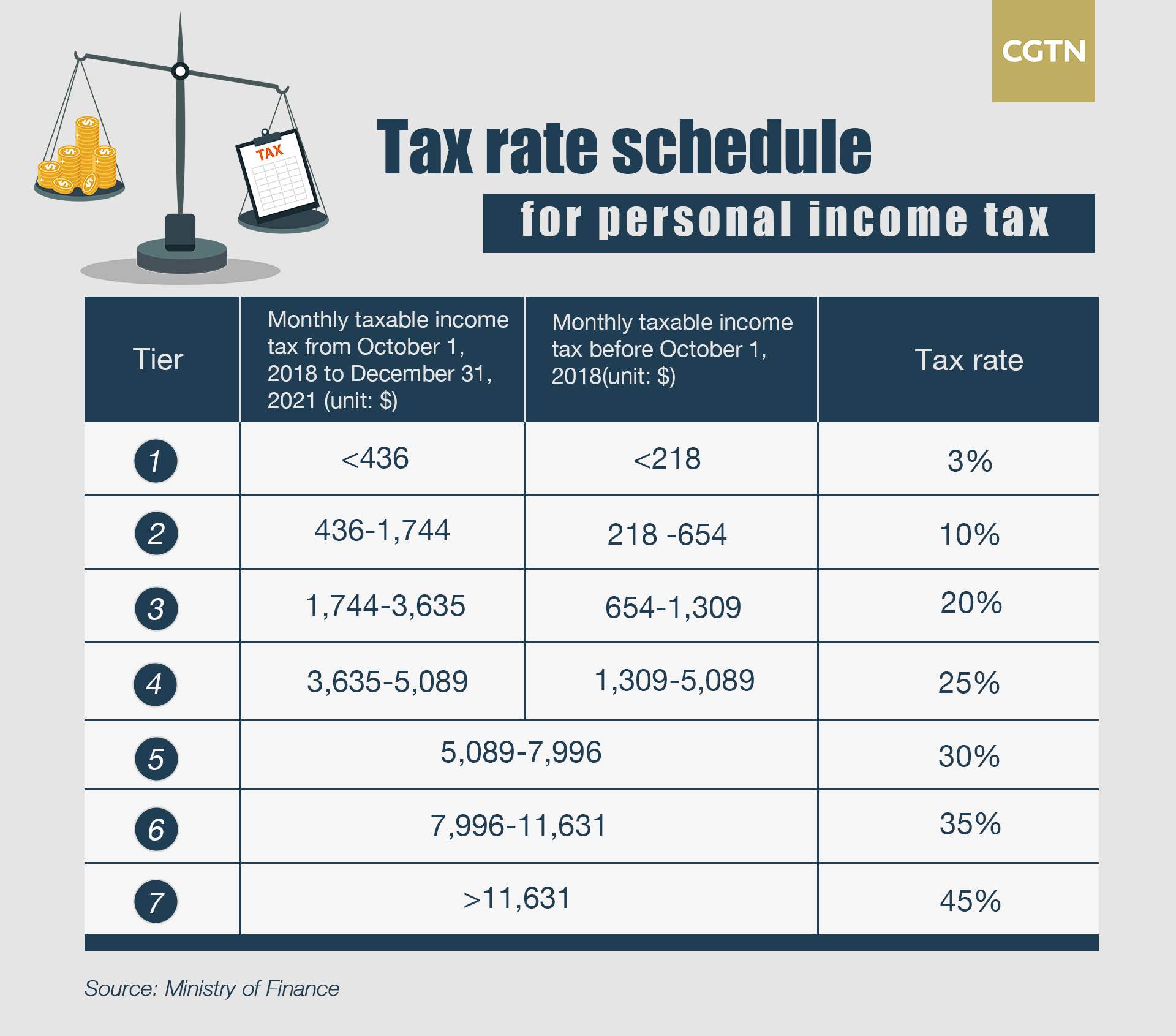

When the new regulation takes effect, the tax rate you pay will be based on your personal income tax rates, which is a progressive rate of 0 percent to 35 percent.

Budget 2022 The Executive Summary Ultima Financial Planners, Personal income tax (ภาษีรายได้ส่วนบุคคล) in thailand is payable on the following forms of income: 2025 federal income tax rates.

Use the income tax estimator to work out your tax refund or debt estimate.

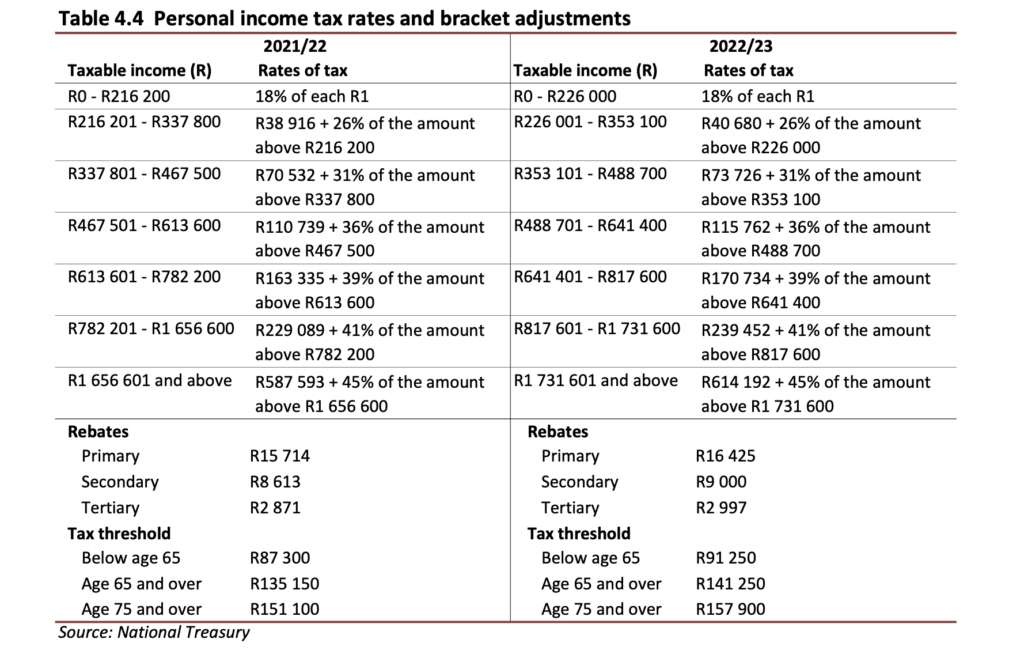

Tax rates for the 2025 year of assessment Just One Lap, The thailand tax calculator includes tax. Personal income tax (pit) is a direct tax levied on income of a person.

Calendar Year Corporate Tax Return Due Date 2025 Calendar 2025, The federal tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1.047 (a 4.7%. For thai residents, foreign income is taxable if it is brought into thailand within the same year it is earned.

Personal Income Tax 2025. As announced in budget 2025, a personal tax rebate will be granted to all tax residents for year of assessment 2025. The federal tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1.047 (a 4.7%.

How much income tax you pay in each tax year depends on:

What is the personal tax? Who must pay?, Personal income tax copy link. Tax residence status of individuals.

Personal Tax Brackets 2025 Casey Cynthea, The tax tables below include the tax rates, thresholds and allowances included in the thailand tax calculator 2025. By filing your tax return on time, you’ll avoid delays to any refund, benefit, or credit payments you may be.